Adding Talent Amid the “Great Resignation”

Hiring part-time workers to fill the human resource gap. This is targeted at advisors, but many employers can adopt some of these practices. Information obtained from - Advisor Perspectives

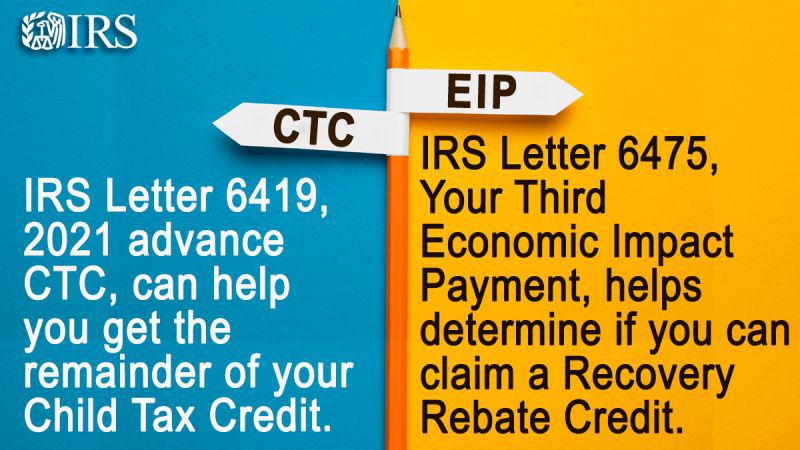

Economic Impact Payment and/or Advanced Child Tax Credit

If you received an Economic Impact Payment and/or Advanced Child Tax Credit payments in 2021 you should be on the lookout for these letters from IRS. You will need them to complete your 2021 income tax returns. Information obtained from IRS

8 reasons to file your tax returns early.

The IRS is scheduled to begin processing 2021 returns in about a week. Here are eight reasons you might want to consider completing your 2021 tax returns soon: 1. To get the rest of the Child Tax Credit2. To get your stimulus payment3. To get your refund sooner4. To...